With interest rates remaining at multi-decade highs, more and more companies will face distress and be forced to evaluate options. If pursuit of lifeline capital or a trade sale exit doesn’t materialize for a company facing creditor uproar and a finite cash runway, winding down may be the unpleasant but necessary next step. Privately held companies in this difficult position should weigh the merits of various paths forward with guidance from trusted advisors.

Available methods have pros and cons:

- An informal wind-down and dissolution is straightforward but likely not feasible if remaining cash is insufficient to pay back creditors.

- A Chapter 11 bankruptcy is a formal reorganization process that plays out in court. Often the best route for companies that have substantial operations and face the threat of heavy litigation, this proceeding rarely makes sense for a small company. It is expensive, public, requires court filings and approval for major actions, and takes at a minimum several months to complete.

- In a Chapter 7 bankruptcy, a court-appointed trustee administers the asset liquidation. Trustees often lack industry knowledge, incentives to act with urgency, and the ability to operate the business, should doing so for a short period benefit creditors.

- A foreclosure sale under UCC Article 9, while quicker and cheaper than bankruptcy, may not yield optimal value for the assets, and requires that the lender take responsibility for the sale effort—which they may not have the resources, expertise, or desire to do.

Enter assignments for the benefit of creditors. An “ABC” is a corporate liquidation process available to an insolvent company that has run out of options. A nimble procedure governed by state statute rather than federal law, ABCs are often an attractive alternative to bankruptcy and other options since they are usually faster, simpler, less expensive, and yield better outcomes. While not suitable for all situations (e.g., a company with highly complex multi-state operations and litigious creditors), an ABC is a recognized proceeding that a board can avail itself of to maximize recovery for creditors and minimize its liability. ABCs have grown in popularity in recent years with venture-backed technology companies and traditional brick-and-mortar firms alike.

Here’s how it works: with consent from its board and shareholders, a distressed company transfers ownership of its assets (technology, inventory, machinery, etc.) to a third-party fiduciary of its choosing—the “Assignee”—through a general assignment agreement. The Assignee then sells the assets in an accelerated timeframe, communicates with stakeholders, distributes remaining cash to creditors, and manages the administrative wind-down of the Company.

While providing the company’s board members and officers with many of the protections of a bankruptcy proceeding, an ABC can be effectuated at a fraction of the cost. ABCs happen without judicial oversight in many states (California, Massachusetts, Illinois, etc.), enabling Assignees to move quickly. A speedy process maximizes creditors’ recovery, since many acquirers want to pursue, in parallel with their purchase of the assets, a company’s customers and key employees as well—who would likely be off the market if the process were to take too long. The Assignee is able to continue to operate the business, as long as those operations are financially solvent.

Exploring an ABC makes sense when it becomes clear runway is limited. If the business will be unable to remain a going concern without the closing of a company sale transaction or capital infusion, contingency planning around wind-down options, including ABCs, is prudent.

When a company approaches insolvency (inability to pay debts as they come due) the board must act with caution since creditors replace shareholders as the primary beneficiaries of any residual value of the business. Directors of an insolvent corporation are exposed to claims from creditors that the directors’ actions harmed enterprise value and thus failed to protect creditors’ interests. If future prospects are limited and ongoing operations would deepen financial troubles, an ABC can be a graceful way to exit and should be considered.

Who benefits in an ABC?

- the creditors – since an experienced Assignee is officially working to maximize their recovery. The Assignee can take the assets to market immediately upon ABC launch (as opposed to the three-to-six-week delay in a Chapter 7 bankruptcy), and engage company personnel to assist, thus preserving asset value and institutional knowledge.

- the board – since they can minimize their liability by resigning day one of the ABC, and do not face the disclosure requirements (and therefore stigma) of a bankruptcy.

- the acquirer – since the assets are sold free and clear of liens and related liabilities, and the sale can close quickly—without the need to obtain court approval (in many states).

- the company’s vendors and customers – since they can start a fresh relationship with the (presumably solvent) asset buyer.

How G2 can help

As a premier financial advisory boutique, G2 helps troubled companies evaluate available options, gain stakeholder buy-in, and implement the best solution. G2’s experience with ABCs and other fiduciary services covers an array of industry sectors and geographies. Our investment banking prowess ensures a professional asset sale process that will yield the highest possible recovery for creditors. G2’s capabilities in special situations span the full range of operational and financial restructuring options available to distressed middle market companies. As an effective tool for both satisfying creditors and allowing stakeholders to exit, an ABC is one such option that a company facing crumbling business prospects may want to consider.

In mid-November each year, operators, investors, advisors, lenders, lawyers, and service providers meet in Las Vegas for the annual convergence of industry insight and expertise: the Restaurant Finance & Development Conference. G2’s Heidi Piché and Jenn Faulk attended and synthesized the key themes coming out of the three-day event.

Everyone is approaching 2024 with caution. Brands wary of consumer cost-consciousness are breaking from existing strategies to test traffic-driving discounts and value offerings. Operators fatigued by ongoing challenges are looking for an exit—likely leading to a spate of seller activity. Lenders are watching how consumers react to recent price increases, subsequent traffic declines, year-over-year profit margin trends, and the overall share-of-wallet relationship as they assess internal credit appetites.

What does all this mean for restaurant operators looking for a life raft—namely, capital or a change-of-control transaction in 2024? We’ve broken down the four most important insights.

Bigger is Better

Why scale matters more than ever.

It is simply more expensive to do business today. The cost of inventory, labor, real estate, and capital improvements have all risen. What’s more, the borrowing index has surged by 200 bps compared to 2022, coupled with elevated risk premiums being charged by lenders. For many, the price to secure the capital is at a premium, but for those who can scale, mainly through acquisition, opportunities await, including:

- Bolstered buying power and cost synergies on overhead

- Easier access to capital due to size and scale

- Premium platform valuations gained through multiple arbitrage

Hold, Please

When waiting to raise capital is wise.

While gaining market mass is one winning strategy, holding tight is another. That’s because there are fewer active lenders today—most with more restrictive credit risk appetites and many prioritizing existing relationships. What’s more, many lenders are reducing leverage at underwriting and covenant setting by at least half a turn. The depth of the syndication market also poses challenges, requiring larger commitments from the top-tier banks. This exclusive credit club leaves a lot of restaurant operators out; therefore, if you have the runway, sit tight with your existing agreements.

If you are still considering borrowing, be aware that most banks require ancillary business, meaning business owners are tying up funds that in prior years could have been used for growth—and are increasingly coming forward with personal deposits to meet requirements. If you are exploring private credit to fill the gap left by the tighter senior credit market, be prepared to pay a premium on top of what senior lenders offer.

Don’t Despair

Which deals are getting done.

The dynamics may seem complex, but the reality is that strategic and private equity groups have capital to deploy and are still actively looking to acquire businesses. Another benefit: Given deal scarcity, strong assets still command competitive processes and high multiples.

Here’s what we expect to see in terms of deal flow and close rates in 2024:

- Conference participants expressed optimism about the prospects for increased M&A activity in 2024, particularly for well-capitalized, credit-worthy companies looking to scale, acquire alternate revenue channels, or underwrite cost synergies.

- Despite a disconnect between buyers and sellers over the last two years, operating trends have stabilized, leading to a compression in the bid/ ask spread between buyer and seller.

- Fatigue is expected to prompt more owners to ask, “Is now the right time to sell?”

- Due diligence will take center stage, resulting in more extensive analyses performed over a longer period and posing higher investment committee hurdles.

More deals and diligence mean a potentially lower close rate but an overall healthier M&A year, resulting in the survival of the fittest.

Get Prepared

How to make a successful exit.

Given today’s market, you must prepare well ahead of an exit. Consider the past and present: Do you have a strong historical track record and the right team to support your business going forward? Are you confident that your operations are strong today and sustainable in the face of future market shifts?

At G2, we are available as a proactive resource to help assess your financial and operational health as well as strategic alternatives. Our sector strength gives us a point of view on where the restaurant industry and lending community are headed—and how not to get left behind.

To learn more about how our industry insight can support your business goals, contact our Consumer & Retail team.

| Heidi Piché Managing Director, Consumer & Retail [email protected] 617.823.9398 | Jenn Faulk Vice President, Consumer & Retail [email protected] 508.654.2346 | Matt Konkle President [email protected] 317.371.6608 |

With G2, the management team elevated its financial and operational acumen and established a foundation for future success. Click to download the full situation summary and solution

THE 2023 BANKING FAILURES

Two weeks ago, Silicon Valley Bank (SVB) became known as the second-largest commercial bank failure in the history of the United States. In the days that followed the collapse, global financial markets witnessed intense turbulence, with several additional dislocations in the bank and credit markets and mounting distress across institutions that had been struggling against the backdrop of a sharp rise in interest rates this past year. With rapidly evolving, dynamic capital markets combined with the media frenzy surrounding the global economy, many fear what could come next. Investors and business owners should focus on safeguarding their businesses for the future.

The G2 team supports its clients and industry partners regardless of circumstances. We guide companies through moments of complexity or rapid change through our deep operational experience and dedicated financial advisory expertise. Over the last 12 years, we have helped over 400 clients navigate complex situations across up and downtrend market cycles.

If you are seeking guidance or looking to better understand potential business implications of the present state of the economy, G2 is here to help. Our restructuring & insolvency, capital markets, investment banking, and interim management teams are ready to extend support through these uncertain times.

You are not alone. Here are some of the ways we can help:

- Our restructuring and insolvency advisors can help triage portfolio exposure and evaluate risk for borrowers/portfolio companies.

- Our capital markets team can secure additional financing to ensure your companies have sufficient liquidity.

- Our team of over 50 professionals is ready to support complex operational needs in helping your company proactively adapt to the changing environment, reduce costs, develop forecasts, and manage liquidity.

- We have a deep bench of interim management executives and subject matter experts to deploy as CEOs, CROs, or CFOs for short or long-term assignments to help your companies navigate the current environment.

Reach out to learn more about how we can support you today.

Revenue was up 55% from 2021, and we have YOU to thank! Serving both investment baking and restructuring clients, our team collectively advised 133 engagements split across four industry teams with $920+ million of total transaction value.

The firm grew substantially with the addition of 19 key team members, and we acknowledged the well-earned promotions of 10+ employees. As we look to 2023, the firm continues on a steep growth trajectory, with a steadfast commitment to meeting the evolving needs of our clients across all stages of the business lifecycle.

We thank you for your support and partnership and are eager to serve as your one-stop-shop in the pursuit of driving long-term growth & maximized value this year.

Our team focuses on assisting private equity partners by providing high quality deal flow, add on acquisition, capital markets and restructuring support. G2 continues to invest in the private equity community as trusted partners of choice.

2022 SELECT TRANSACTIONS COMPLETED WITH SPONSORS

PARTNERS FROM BEGINNING TO END.

G2 Capital Advisors provides M&A, capital markets, and restructuring advisory services to the middle market. We offer integrated, multi-product, and sector-focused services by pairing highly experienced C-level executives with specialist investment bankers. We aspire to be the trusted advisor of choice.

CAPABILITIES:

INDUSTRY FOCUS:

Record-breaking post-Holiday sales masked a marked slowdown in overall retail spending. Despite Black Friday and Cyber Monday sales surpassing $20 billion for the first time in history, U.S. retail spending experienced its most significant decline of the year, suggesting households are making strategic financial decisions as they plan for the road ahead. The economy remains at an unprecedented crossroads, with many questions looming:

Will inflation continue to slow, and how much further could interest rates rise? The Fed continues to raise rates at a slightly slower pace and has signaled its intention to continue doing so at least through the spring.

Will a slightly slowing economy morph into a full-blown recession, and will the labor market remain strong? While sales and margins show signs of softening, the labor market continues to defy expectations, making it hard for the Federal Reserve to further ease the policy. Layoffs in the technology, media and real estate industries make headlines. Still, they represent a minuscule portion of the labor force, with overall jobless claims falling by 20,000.

How much longer will pandemic-era savings and easing supply chains buttress consumer spending, and will they continue to spend more on necessities? While personal savings soared to nearly $6.5 trillion in 2020, they’ve since dropped to below $500 billion, lower than the $1.4 trillion pre-pandemic. Despite supply chain imbalances driving discount sales as retailers looked to shed excess inventory, consumers are focusing their budgets on food and other staples and spending less on holiday categories such as electronics, clothing, and sporting goods.

Ultimately, is a recession inevitable, and how bad might it get? This remains anyone’s prediction, but for business owners, management teams, and industry leaders, any level of uncertainty should be met head-on – waiting to seek clarity can be a losing move.

Connect with G2 to discuss your 2023 strategic objectives. At G2 Capital Advisors, deep sector and operational expertise underscore our dedication to achieving success at all costs. We support clients through both healthy market cycles and times of distress, with a refusal to fail. We provide highly tailored advice to company-specific circumstances in an ever-changing world. Reach out today to start the conversation.

On the heels of the most extended credit cycle in recent memory, the last six months have delivered a long overdue dose of economic reality. Middle-market borrowers have enjoyed 10+ years of historically low rates and loose lending conditions (save for the brief, covid-induced, recession-that-wasn’t in mid-2020). However, the lending environment has changed due to the inflationary conditions we experience every day and the Fed’s actions to curtail them.

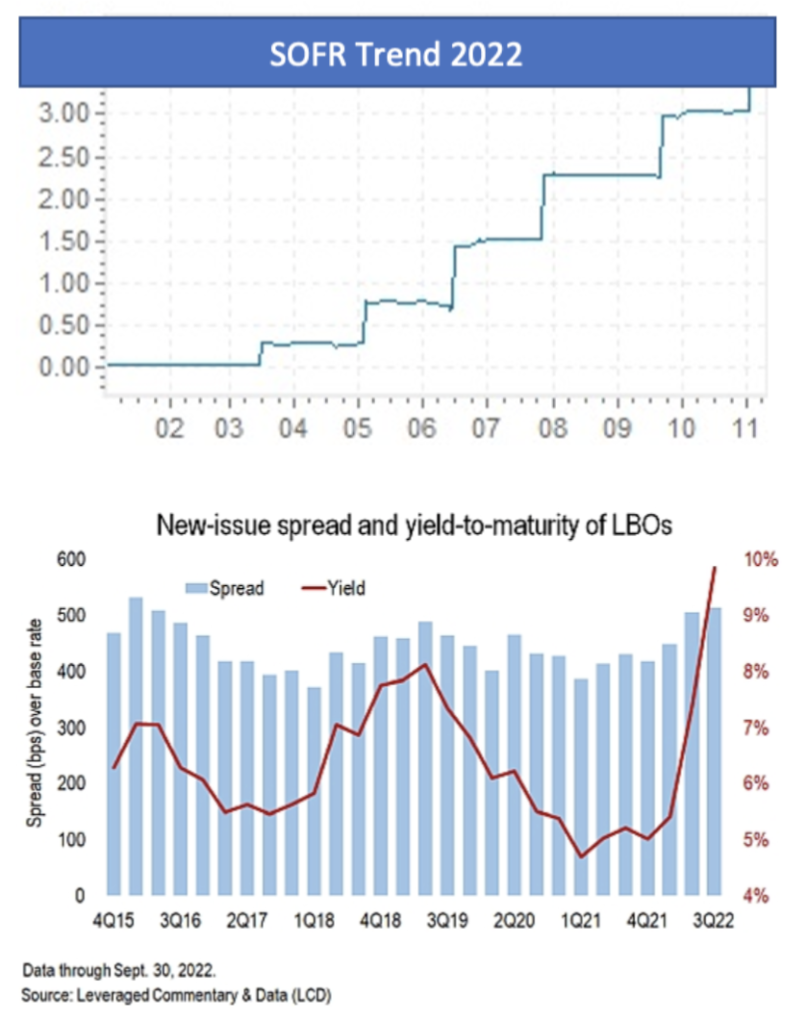

The Fed has raised the benchmark Fed Funds Rate 6 times and 375 basis points since March, with an additional 50-75 basis point increase expected in Mid-December. In turn, companies have seen borrowing costs skyrocket; SOFR, the index rate for new-issue corporate loans, stood at 3.8% on November 30th after beginning the year at near zero.

This SOFR spike, combined with middle market spreads that have widened ~75-150 bps and original issue discounts (OIDs) that have increased to 1.5-2.5% have driven yields for middle market senior secured loans to ~11-12% versus 5.75-7.25% at the end of Q1.

At the current levels, interest expense for a 4x levered business consumes 45% of EBITDA, which substantially limits debt capacity and has the knock-on effect of softening valuations. What’s more, the 3-month Term SOFR forward curve peaks at 4.9% in April ’23 and remains above 4% through March ’24.

Now that we’ve addressed the bad, here’s the good: while lending conditions have deteriorated, this downcycle will bear little resemblance to 2008/09 due to the secular shift in the composition of middle market lenders.

Fundamental Shift in Middle Market Loan Demand

The lender landscape has changed materially since 2009. In the halcyon days of 2005-2007, commercial banks and institutional investors, i.e., pro rata and institutional syndicated loans, accounted for over 90% of middle market volume. Private credit was in its relative infancy and hardly moved the needle regarding loan volume. Thirteen years later, private credit is now the dominant source of financing for middle market companies with a market size of $1.2 trillion vs. $284 billion in 2008.

Why Does it Matter

Looking back on the GFC, it was characterized by an utter lack of liquidity, including within the middle market. But as previously noted, commercial banks accounted for the lion’s share of volume. As risk-off entities whose primary objective is to not lose money, when the proverbial music stopped in 2008, so did their desire and willingness to provide new credit. In fact, it was banks’ withdrawal from the market that turbocharged private credit’s growth.

Conversely, private lenders have different capabilities and incentives to deploy capital in times of volatility. First, rather than avoiding risk, private lenders price, and structure around it. Second, fund managers are compensated for deploying capital, not waiting out the storm. One need not look any further back than Q3, when, per LCD, “direct lending deals tracked by LCD exceeded syndicated loans and high yield bonds…combined.”

As a result of the new landscape, the private credit market will remain open for business regardless of the depth of the looming recession, and financing will remain available for most borrowers, albeit with very lender-friendly pricing and terms.

Even with some softening in the capital markets and ongoing challenges of inflation, talent shortages, and supply issues, the current landscape continues to be a highly competitive market for acquirers to find, connect and purchase businesses. Here are 10 best practices to increase the likelihood of success if you are attempting to build and execute a proprietary acquisition process

Stop searching for Goldilocks. The perfect company does not exist, so stop looking for it. Buyers spend much time early in their search, looking for the ideal company. All companies are a combination of interrelated attributes. Each attribute should be ranked using repeatable and objective metrics. For example, a simple “high to low” ranking concerning risk, fit with the company, upside opportunity, and overall adherence to acquisition criteria can be highly beneficial. You rarely find an issue-free company; if you wait for one to come along, you may never acquire one.

Don’t take on this effort alone. Be honest about how much time you can dedicate, your level of deal experience, your knowledge of the marketplace, and the quality of your network. Having a well-rounded team involved brings different perspectives and insights. The right team increases bandwidth to connect with targets and gather and review information while reducing the probability of missed information or deal bias.

Marketplace relationships are great, but they do not guarantee a pipeline of deals. Your existing relationships can be a double edge sword. Target companies may have a preconceived view of you, your team, your company, or your brand. This bias may be due to an ill-fated interaction in the past, and as a result, you may never get a chance to talk to the target. Additionally, some targets may be unwilling to engage because they view you as a competitor. Or there may be a concern that you are trying to gather market intel. While having companies and people in your CRM is helpful, it will never replace continuously finding creative ways to connect with targets that fit your strategy.

Be prepared to share. Buyers often think Sellers are ready and willing to quickly share their company’s financial information, analysis, and secret sauce. The reality is that most are not. An effective way to get a Seller to open up is by sharing with them first. Be ready to tell your story. How did you get into the business? Why do customers and employees choose you versus someone else? What are your biggest challenges or concerns? Sharing key high-level financial metrics: topline revenue, revenue mix, and growth is a sign that you are entering into this conversation as equals. Remember that there are many Buyers out there. What makes you unique? Keep it succinct but make it personal. You want to earn the Seller’s trust. In the end, trust drives open dialogue about more sensitive information, which you will need to advance the conversation to valuation and structure.

Be flexible; the journey is not linear. The M&A journey is a rollercoaster of high activity and slow periods where you may go days, even weeks, without an actionable next step or exciting opportunity. It is critical to remain positive, prescriptive, and patient. Creating an unnecessary sense of urgency with a proprietary Seller is counterproductive. Very few Sellers dedicate time and resources to a sale effort, at least initially. Sellers naturally keep discussions close to their chest to reduce the likelihood of employees discovering their plans. A Seller’s timeline is often misaligned with yours, but that does not mean they are not working towards the same goal. During the pursuit of acquisitions, remember that statistically, it’s not a matter of “if” an owner will sell; it’s a matter of “when.” Patience and persistence are critical.

Be transparent in how you approach valuing the business. When you have gathered enough intel and information to have views on valuation and structure, share that with the Seller. Transparency allows for open and objective dialogue about the risks and opportunities of the business. Through discussions and review of additional supporting materials, you will feel comfortable placing the right weight on a particular finding and how it impacts the structure or valuation. Transparency increases the likelihood of agreeing on a mutually beneficial way to get a deal done, whether now or down the road.

Motivations are only sometimes obvious. While it can save time to jump to “what is it going to take to get the deal done,” it’s generally not wise to do so until you are ready. This approach on the first phone call or face-to-face meeting can be off-putting to the target. It may create a confrontational tone if it does not push the target away. The motivations and emotions of the Seller are what drive the discussions. These elements take time to reveal themselves. Uncovering them requires attentive listening to the answers given in response to your questions. Allow for the discussion and the relationship to evolve naturally.

Reserve judgment of a Seller that lacks financial expertise. You will encounter attractive businesses with wildly successful owners that cannot articulate their profitability, need to learn or understand GAAP (generally accepted accounting principles), and are materially off on the size and scale of the business. You should be prepared to roll up your sleeves to understand how a target makes money. It is common for owners of middle-market companies to operate based on cash in the bank and the size of their tax liability. Their financial acumen and the quality of their financials will present themselves early in the relationship. Encourage them to involve their accountant or someone else with a more robust handle on the numbers as early as possible.

As the process unfolds, a Seller’s “number” may change. Be prepared that the first honest feedback from the Seller comes when you tender your first offer – even if many of the terms have been discussed and verbally acknowledged. Sharing the offer in writing formalizes and often recalibrates the process. This may be the first-time outside advisors (CPAs, Attorneys, Wealth Management Professionals, Intermediaries, Investment Bankers, or spouses) get involved. These advisors often do not know you or your intentions and are unaware of the inherent or perceived risks and concerns discussed with the owner as you’ve developed your valuation and deal structure. Many buyers gloss over those topics when sharing their advisors’ indication of interest (IOI) or letter of intent (LOI). So, be ready to explain and defend your position objectively. Also, be prepared for the resulting response or counteroffer to be significantly different from the discussions leading up to that point. Listen to what the Seller says. Know your walk-away number; if reached, do just that, and you will find another opportunity.

Remember, buying a company is a marathon, not a sprint. Accepting this will allow opportunities to develop and evolve at a natural pace. Treat everyone with respect, be open and honest in your feedback, and never forget it is not a matter of “if” an owner will sell; it is simply a matter of “when.”

While the economic outlook for middle market companies is mixed as we move into 2023, there are still opportunities for growth and success. By being strategic and focused on operational efficiency, cost optimization, and alternative financing options, middle-market companies can navigate these challenges and emerge stronger on the other side.

The rising-rate environment will have an enormous impact on the middle market. Buyers will be more selective and diligent in the companies they acquire, and available liquidity and deal flow will likely decline. Floating-rate debt issuers are especially vulnerable today—particularly those with heavy interest burdens, limited free cash flow, and near-term maturities.

Brian Schofield, MD, Head of Capital Markets, G2 Capital Advisors

The tightening monetary policy, declining GDP growth, and lower public and private valuations will see an impact on middle-market companies in the coming months. With the concern of inflation, the economy slowing down and more, this is what we can expect to see from the middle market:

- Selective and diligent buyers

- Declining deal flow and available liquidity

- Vulnerability among companies

- Covenant-lite loans may assuage default concerns

- Evolutions of investors’ ties with “storied” credits

Our G2 team provides a unique platform, combining deep operational industry experience with capital markets product expertise to meet client growth goals and special situations.

Learn more about our capital marketing advisory.

Capital market analysis & backdrop

Increase in inflation rate remains a crucial concern: After months of claiming inflation was “transitory,” the U.S. Federal Reserve (the Fed) has found itself behind the curve, fighting the highest inflation rate in four decades. The Consumer Price Index (CPI) increased 8.5% for the 12 months ended March 2022, following a year-over-year rise of 7.9% as of February 2022.

The Fed is aggressively tightening monetary policy: The Fed is hiking interest rates—its most aggressive pace of policy tightening since the early 2000s. The Fed voted to raise interest rates by 25 bps in March and 50 bps in May and anticipates an additional 50 bps of hikes during its next two meetings. In addition, the Fed has begun to shrink its $9 trillion balance sheet. Meanwhile, the 10-year Treasury rate is hovering around 3.0%, its highest level since November 2018.

Declining growth as economy is slowing down: U.S. GDP growth fell to 1.4% in the first quarter. However, it was affected by certain factors that should ease throughout the year, including spiking COVID cases and slowing inventory growth. The Fed must balance tightening activity with the risk of tipping the U.S. economy into a recession.

Public markets have been hit hard: Rising interest rates, inflationary pressures, and geopolitical instability have resulted in a public market rout since the beginning of the year. While technology companies and other growth investments have seen the most significant impact, the sell-off has been broad-based and is spilling into the private markets, as further discussed below.

What does this mean for the middle market?

Expect buyers to become more selective and diligent: Valuations in the public markets tend to have a gravitational pull on private transactions. We expect buyers in the middle market to dig in further during due diligence and be highly selective in the companies they seek to acquire.

Available liquidity and deal flow will likely decline: Demand for middle-market loans may exhibit volatility in the second of 2022 as it did in the second quarter of 2020 when deal flow slowed significantly due to uncertainty surrounding the pandemic. Increased borrowing costs will render opportunistic financings less attractive and likely result in muted loan volume for the balance of 2022.

Some companies are more vulnerable than others: Due to the prevalence of floating-rate, debt-heavy capital structures, debt-bearing middle market businesses and loan issuers are more vulnerable than their larger corporate counterparts. Especially vulnerable are companies with limited free cash flow, heavy interest burdens, and near-term maturities that will need to be refinanced at higher interest rates.

Covenant-lite loans may assuage default concerns: A heavy mix of covenant-lite loans, which weaken creditor protections, may help stave off defaults. When debt agreements include maintenance covenants, improved operating performance can mitigate the effects of higher interest rates as monetary policy continues to tighten.

Investors’ willingness to lean in on “storied” credits will evolve: After massive deal activity in late 2021, deal flow has decreased in early 2022, and investors have been more willing to consider complex credits this year. But we expect investor demand to pull back from storied credits as the forward calendar continues to build and scrutiny from lenders increases due to current headwinds.

Market volatility is high, and interest rates are projected to rise. For middle market companies looking to raise capital, now is an opportune time to leverage the expertise of a seasoned capital markets team to navigate the complex market environment and provide greater certainty of execution.”

Brian Schofield, MD, Head of Capital Markets, G2 Capital Advisors

How do these trends affect you?

Our capital markets team would welcome the opportunity to share our perspectives on today’s dynamic capital markets environment and how it affects your specific situation. We have deep experience providing strategic capital markets advice to middle market companies, and we pride ourselves on making the deal experience as efficient as possible for management teams and owners. Contact us to start a conversation today and begin working towards your capital market goals.