G2 CAPITAL ADVISORS SERVED AS THE EXCLUSIVE BUY-SIDE ADVISOR TO PEAK TOOLWORKS ON ITS ACQUISITION OF EXPERT DIE INC., A LEADER IN BLADE SALES AND SHARPENING SERVICES ACROSS THE SOUTHEAST UNITED STATES.

CLIENT

Peak Toolworks (“Peak”) is North America’s largest manufacturer of engineered diamond and carbide cutting tools serving the secondary woodworking, metal, composite, and other end markets. With two manufacturing facilities and 12 service centers across the United States and Canada, Peak provides customers a regionally focused network of direct sales and service, offering direct access to the top cutting tool brands from one convenient source. Peak puts people first in everything they do, allowing them to be a trusted, reliable partner for their clients.

SITUATION

Peak has a well-established reputation as the largest network in North America for cutting tools. To advance its service offering and capabilities to better service its clients, Peak implemented a successful M&A strategy to partner with a business that expands their geographical presence and service capabilities.

ENGAGEMENT

G2 Capital Advisors, LLC (“G2”) served as the exclusive buy-side advisor to Peak, leading a bespoke buy-side effort focused on identifying and engaging with businesses with a strong market presence and service offering within the cutting & sharpening industry.

OUTCOME

G2’s mandate with Peak Toolworks began in 2020 and led to the successful acquisition of Expert Die Inc. The acquisition brings industrial knife sharpening to the Peak service portfolio, offering new sharpening & repair locations as well as new sales capabilities to Peak’s existing customers. Additionally, Peak’s acquisition of Expert Die Inc. creates new relationships that will lead to new avenues for growth.

Kerry Baskins, President & CEO of Peak Toolworks, commented, “I am excited to add Expert Die to the Peak family. We are pleased with the work G2 Capital Advisors dedicated to this acquisition to help share our culture, goals, and vision with Expert Die.”

“Expert Die, Inc. has an exceptional brand name and reputation. This acquisition will significantly grow Peaks footprint while also increasing our ability to drive additional value for our customers across the country. We are excited to continue executing on the Peak strategy and look forward to the company’s further growth.”

CONTACTS ON THIS DEAL:

Victoria Arrigoni, MD, Head of Industrials & Manufacturing M: 619.742.6441 E: [email protected]

Matt Ball, Vice President M: 978.914.4421 E: [email protected]

Zachary Kalman, Associate M: 413-351-1491 E: [email protected]

Revenue was up 55% from 2021, and we have YOU to thank! Serving both investment baking and restructuring clients, our team collectively advised 133 engagements split across four industry teams with $920+ million of total transaction value.

The firm grew substantially with the addition of 19 key team members, and we acknowledged the well-earned promotions of 10+ employees. As we look to 2023, the firm continues on a steep growth trajectory, with a steadfast commitment to meeting the evolving needs of our clients across all stages of the business lifecycle.

We thank you for your support and partnership and are eager to serve as your one-stop-shop in the pursuit of driving long-term growth & maximized value this year.

Record-breaking post-Holiday sales masked a marked slowdown in overall retail spending. Despite Black Friday and Cyber Monday sales surpassing $20 billion for the first time in history, U.S. retail spending experienced its most significant decline of the year, suggesting households are making strategic financial decisions as they plan for the road ahead. The economy remains at an unprecedented crossroads, with many questions looming:

Will inflation continue to slow, and how much further could interest rates rise? The Fed continues to raise rates at a slightly slower pace and has signaled its intention to continue doing so at least through the spring.

Will a slightly slowing economy morph into a full-blown recession, and will the labor market remain strong? While sales and margins show signs of softening, the labor market continues to defy expectations, making it hard for the Federal Reserve to further ease the policy. Layoffs in the technology, media and real estate industries make headlines. Still, they represent a minuscule portion of the labor force, with overall jobless claims falling by 20,000.

How much longer will pandemic-era savings and easing supply chains buttress consumer spending, and will they continue to spend more on necessities? While personal savings soared to nearly $6.5 trillion in 2020, they’ve since dropped to below $500 billion, lower than the $1.4 trillion pre-pandemic. Despite supply chain imbalances driving discount sales as retailers looked to shed excess inventory, consumers are focusing their budgets on food and other staples and spending less on holiday categories such as electronics, clothing, and sporting goods.

Ultimately, is a recession inevitable, and how bad might it get? This remains anyone’s prediction, but for business owners, management teams, and industry leaders, any level of uncertainty should be met head-on – waiting to seek clarity can be a losing move.

Connect with G2 to discuss your 2023 strategic objectives. At G2 Capital Advisors, deep sector and operational expertise underscore our dedication to achieving success at all costs. We support clients through both healthy market cycles and times of distress, with a refusal to fail. We provide highly tailored advice to company-specific circumstances in an ever-changing world. Reach out today to start the conversation.

On the heels of the most extended credit cycle in recent memory, the last six months have delivered a long overdue dose of economic reality. Middle-market borrowers have enjoyed 10+ years of historically low rates and loose lending conditions (save for the brief, covid-induced, recession-that-wasn’t in mid-2020). However, the lending environment has changed due to the inflationary conditions we experience every day and the Fed’s actions to curtail them.

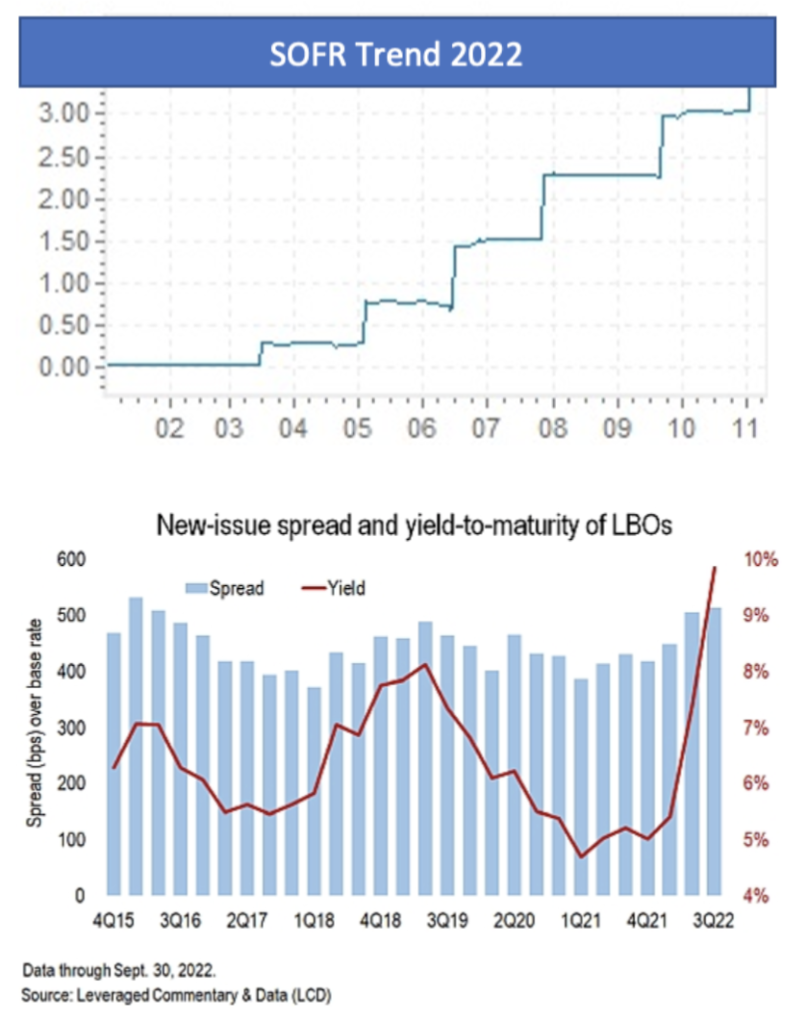

The Fed has raised the benchmark Fed Funds Rate 6 times and 375 basis points since March, with an additional 50-75 basis point increase expected in Mid-December. In turn, companies have seen borrowing costs skyrocket; SOFR, the index rate for new-issue corporate loans, stood at 3.8% on November 30th after beginning the year at near zero.

This SOFR spike, combined with middle market spreads that have widened ~75-150 bps and original issue discounts (OIDs) that have increased to 1.5-2.5% have driven yields for middle market senior secured loans to ~11-12% versus 5.75-7.25% at the end of Q1.

At the current levels, interest expense for a 4x levered business consumes 45% of EBITDA, which substantially limits debt capacity and has the knock-on effect of softening valuations. What’s more, the 3-month Term SOFR forward curve peaks at 4.9% in April ’23 and remains above 4% through March ’24.

Now that we’ve addressed the bad, here’s the good: while lending conditions have deteriorated, this downcycle will bear little resemblance to 2008/09 due to the secular shift in the composition of middle market lenders.

Fundamental Shift in Middle Market Loan Demand

The lender landscape has changed materially since 2009. In the halcyon days of 2005-2007, commercial banks and institutional investors, i.e., pro rata and institutional syndicated loans, accounted for over 90% of middle market volume. Private credit was in its relative infancy and hardly moved the needle regarding loan volume. Thirteen years later, private credit is now the dominant source of financing for middle market companies with a market size of $1.2 trillion vs. $284 billion in 2008.

Why Does it Matter

Looking back on the GFC, it was characterized by an utter lack of liquidity, including within the middle market. But as previously noted, commercial banks accounted for the lion’s share of volume. As risk-off entities whose primary objective is to not lose money, when the proverbial music stopped in 2008, so did their desire and willingness to provide new credit. In fact, it was banks’ withdrawal from the market that turbocharged private credit’s growth.

Conversely, private lenders have different capabilities and incentives to deploy capital in times of volatility. First, rather than avoiding risk, private lenders price, and structure around it. Second, fund managers are compensated for deploying capital, not waiting out the storm. One need not look any further back than Q3, when, per LCD, “direct lending deals tracked by LCD exceeded syndicated loans and high yield bonds…combined.”

As a result of the new landscape, the private credit market will remain open for business regardless of the depth of the looming recession, and financing will remain available for most borrowers, albeit with very lender-friendly pricing and terms.

Even with some softening in the capital markets and ongoing challenges of inflation, talent shortages, and supply issues, the current landscape continues to be a highly competitive market for acquirers to find, connect and purchase businesses. Here are 10 best practices to increase the likelihood of success if you are attempting to build and execute a proprietary acquisition process

Stop searching for Goldilocks. The perfect company does not exist, so stop looking for it. Buyers spend much time early in their search, looking for the ideal company. All companies are a combination of interrelated attributes. Each attribute should be ranked using repeatable and objective metrics. For example, a simple “high to low” ranking concerning risk, fit with the company, upside opportunity, and overall adherence to acquisition criteria can be highly beneficial. You rarely find an issue-free company; if you wait for one to come along, you may never acquire one.

Don’t take on this effort alone. Be honest about how much time you can dedicate, your level of deal experience, your knowledge of the marketplace, and the quality of your network. Having a well-rounded team involved brings different perspectives and insights. The right team increases bandwidth to connect with targets and gather and review information while reducing the probability of missed information or deal bias.

Marketplace relationships are great, but they do not guarantee a pipeline of deals. Your existing relationships can be a double edge sword. Target companies may have a preconceived view of you, your team, your company, or your brand. This bias may be due to an ill-fated interaction in the past, and as a result, you may never get a chance to talk to the target. Additionally, some targets may be unwilling to engage because they view you as a competitor. Or there may be a concern that you are trying to gather market intel. While having companies and people in your CRM is helpful, it will never replace continuously finding creative ways to connect with targets that fit your strategy.

Be prepared to share. Buyers often think Sellers are ready and willing to quickly share their company’s financial information, analysis, and secret sauce. The reality is that most are not. An effective way to get a Seller to open up is by sharing with them first. Be ready to tell your story. How did you get into the business? Why do customers and employees choose you versus someone else? What are your biggest challenges or concerns? Sharing key high-level financial metrics: topline revenue, revenue mix, and growth is a sign that you are entering into this conversation as equals. Remember that there are many Buyers out there. What makes you unique? Keep it succinct but make it personal. You want to earn the Seller’s trust. In the end, trust drives open dialogue about more sensitive information, which you will need to advance the conversation to valuation and structure.

Be flexible; the journey is not linear. The M&A journey is a rollercoaster of high activity and slow periods where you may go days, even weeks, without an actionable next step or exciting opportunity. It is critical to remain positive, prescriptive, and patient. Creating an unnecessary sense of urgency with a proprietary Seller is counterproductive. Very few Sellers dedicate time and resources to a sale effort, at least initially. Sellers naturally keep discussions close to their chest to reduce the likelihood of employees discovering their plans. A Seller’s timeline is often misaligned with yours, but that does not mean they are not working towards the same goal. During the pursuit of acquisitions, remember that statistically, it’s not a matter of “if” an owner will sell; it’s a matter of “when.” Patience and persistence are critical.

Be transparent in how you approach valuing the business. When you have gathered enough intel and information to have views on valuation and structure, share that with the Seller. Transparency allows for open and objective dialogue about the risks and opportunities of the business. Through discussions and review of additional supporting materials, you will feel comfortable placing the right weight on a particular finding and how it impacts the structure or valuation. Transparency increases the likelihood of agreeing on a mutually beneficial way to get a deal done, whether now or down the road.

Motivations are only sometimes obvious. While it can save time to jump to “what is it going to take to get the deal done,” it’s generally not wise to do so until you are ready. This approach on the first phone call or face-to-face meeting can be off-putting to the target. It may create a confrontational tone if it does not push the target away. The motivations and emotions of the Seller are what drive the discussions. These elements take time to reveal themselves. Uncovering them requires attentive listening to the answers given in response to your questions. Allow for the discussion and the relationship to evolve naturally.

Reserve judgment of a Seller that lacks financial expertise. You will encounter attractive businesses with wildly successful owners that cannot articulate their profitability, need to learn or understand GAAP (generally accepted accounting principles), and are materially off on the size and scale of the business. You should be prepared to roll up your sleeves to understand how a target makes money. It is common for owners of middle-market companies to operate based on cash in the bank and the size of their tax liability. Their financial acumen and the quality of their financials will present themselves early in the relationship. Encourage them to involve their accountant or someone else with a more robust handle on the numbers as early as possible.

As the process unfolds, a Seller’s “number” may change. Be prepared that the first honest feedback from the Seller comes when you tender your first offer – even if many of the terms have been discussed and verbally acknowledged. Sharing the offer in writing formalizes and often recalibrates the process. This may be the first-time outside advisors (CPAs, Attorneys, Wealth Management Professionals, Intermediaries, Investment Bankers, or spouses) get involved. These advisors often do not know you or your intentions and are unaware of the inherent or perceived risks and concerns discussed with the owner as you’ve developed your valuation and deal structure. Many buyers gloss over those topics when sharing their advisors’ indication of interest (IOI) or letter of intent (LOI). So, be ready to explain and defend your position objectively. Also, be prepared for the resulting response or counteroffer to be significantly different from the discussions leading up to that point. Listen to what the Seller says. Know your walk-away number; if reached, do just that, and you will find another opportunity.

Remember, buying a company is a marathon, not a sprint. Accepting this will allow opportunities to develop and evolve at a natural pace. Treat everyone with respect, be open and honest in your feedback, and never forget it is not a matter of “if” an owner will sell; it is simply a matter of “when.”

G2 Capital Advisors is pleased to present its Transportation & Logistics industry update for Q3 2022, providing commentary and analysis on M&A and market trends within the sector.

After continued momentum across global transportation services in 1H 2022, a 60%+ year-over-year decrease in global container freight rates (as measured by the Freightos Baltic Index) in Q3 has reinforced economic weakness. More specifically, the cost to ship products across the Trans-Pacific trade lane has cooled from record highs of over $20,000 per container in Q3 2021 to less than $3,000 per container by September 2022. These trends are signaling a drop in consumer demand amid rising inflation and a rebalancing of consumer spending to essential goods and services, while retailers manage bloated inventory levels and temper expectations for holiday spend.

As demand growth has stalled from a muted peak season, ocean vessels are not fully utilized causing spot rates to drop below contract rates. These carriers have increased blank sailings as a strategy to match supply with demand in hopes of establishing a pricing floor. It remains uncertain how quickly this imbalance will correct and whether carriers will be forced to maintain lower capacity in response to the declines experienced across most major shipping routes.

Pricing pressure remains the primary industry challenge which has forced freight forwarders to continue adopting and tailoring processes, technologies and service capabilities to further differentiate their solutions. Those providers with an automated, self-service solution that can provide real-time visibility portals, rate optimization engines, and effective analytics and reporting for customer milestone communication will differentiate their services, improve customer retention and drive future growth and profitability through an uncertain market.

G2 Capital Advisors is pleased to present its Technology & Business Services (“T&BS”) industry update for Q3 2022, providing commentary and analysis on M&A and market trends within the Technology & Business Services sectors and sub-sectors.

The US economic outlook remains uncertain with a general negative sentiment. While supply chain issues are easing, the hiring and job markets remain strong, and consumer spending while slowing is not plummeting, The Conference Board forecasts that economic weakness will intensify and spread more broadly over the coming months driven by inflation and a hawkish Federal Reserve stepping in to aggressively increase the federal funds rate. The Federal Reserve typically walks rates up slowly because they work with a lag, but one that can be powerful. The current rate of increases has them moving more quickly to offset the lag which is a delicate balance. The Federal Reserve’s rate increases represent the fastest tightening since the 1980s when they ultimately raised rates to nearly 20%, sending unemployment to greater than 10%.

The impact on the T&BS M&A market is largely just emerging. We are seeing a slowdown in response increasing costs of leverage and the general uncertainty in the market as well as a marked increase in scrutiny of fit and during diligence. Additionally, many private equity firms were able to return capital to investors from strong exits over the last couple of years, taking the pressure off near term exits. However, quality deals are getting done and 2022 volume is expected to be up from pre-pandemic levels.

Several sectors in particular have seen increased deal volume generated by significant tailwinds. Cybersecurity software and services deals have received interest and attention driven by the ongoing diplomatic tensions between the US and Russia created by Russia’s invasion of Ukraine earlier in the year, as well as the continued fraying of relations with China in response to a host of factors. There has been a similar boom in IT consulting services sector, as companies continue to need highly-specialized, knowledgeable consultants to help them adapt to the ever-changing technology landscape and offset a tight skilled labor force.

G2 Capital Advisors is pleased to present its Consumer & Retail industry update for Q3 2022, providing commentary and analysis on M&A and market trends within the Consumer & Retail sectors.

The world’s largest fast-moving consumer goods companies saw robust growth following the global pandemic, and exhibited resilience in the wake of supply chain constraints and the sharp rise in inflation. In fact, the sector not only survived – it thrived, with average sales exceeding pre-pandemic levels. That said, as sentiment has coalesced around a near-certain downturn, performance is not surprisingly bifurcating between staples and discretionary goods, with prospects for the latter turning sharply.

High inflation, supply chain issues, and increasing recession worries are all factors pressuring the consumer discretionary sector, which already faces the greatest sensitivity to economic cycles. In Q3 2022, discretionary goods companies saw increases in two risk criteria – lowered corporate guidance and greater short interest. Companies in the sector that lowered guidance doubled vs Q2 and increased ten-fold vs Q1, with short interest surpassing all other industries.

Consumer staples, on the other hand, held up better than the broader market, consistent with prior downturns. While the S&P tumbled 25% through Q3, consumer staples stocks fell less than half that, playing their traditionally defensive role. Nonetheless, consumers are now choosing what and where to buy differently, as the pandemic shifted a growing portion of food sales online. Moreover, while many brands enjoy pricing power over private label products, they are nonetheless vulnerable to premium house brands from the likes of Whole Foods and Trader Joe’s.

After years of grappling with the rise of online shopping, brick-and-mortar retailers are posting some of their best results, with retail vacancies at a 15-year low and plans for expansion underway as consumers continue to venture out post-pandemic. In fact, sale growth among physical stores is outpacing that of e-commerce, as the pandemic forced companies to expand and better integrate their omni-channel offerings. While still vulnerable, the retail industry nonetheless appears better-positioned than in prior downturns.

G2 Capital Advisors is pleased to present its Industrials & Manufacturing industry update for Q3 2022, providing commentary and analysis on M&A and market trends within the Industrials & Manufacturing sectors.

A historic, $1.2T of funding has been approved to invest in aging infrastructure nationwide through the Infrastructure Investment and Jobs Act (“IIJA”), coupled with additional investment of $52B through the CHIPS Act and $700B through the Inflation Reduction Act. Construction services firms have been buoyed by the news of the injections, promising years of bumper backlogs and a reliable end customer in the U.S. government. Unfortunately, new investment can’t conjure up a much-needed base of skilled laborers, as the war for talent rages on. Only 80% of the 1MM construction workers who lost their jobs at the beginning of the pandemic have returned, in the face of an estimated 1MM additional workers required in the near term to keep up with high demand. Firms have been forced into bidding wars and are providing more clearly defined career trajectories to attract new workers. As the U.S. hovers over a recessionary state, pressure on wage growth should ease more broadly, but will likely remain an acute issue for the construction services industry as demand is supported by government policy. With spending under the infrastructure law expected to peak in 2027-28, the labor strain is set to become a longer term, structural issue.

The $700B Inflation Reduction Act includes a rejuvenated solar power incentive, increasing the existing tax rebate from 26% to 30% for a period of ten years through 2032. Originally scheduled to phase out between 2020 and 2023, the reboot will be partially financed by a 15% alternative minimum tax on some large U.S. corporations and a 1% excise tax on certain corporate share repurchases. The Biden administration aims to further increase investment and development of renewable energy alternatives, providing a significant boon to developers and investors. This backdrop of robust demand has allowed firms to pass inflationary pressures on to end customers, offsetting the impact on their businesses.

While demand for the construction services and renewable energies sectors will remain robust, supported by extraordinary government funding, industry players will need to combat persistent labor shortages likely to endure through a forecasted recession.

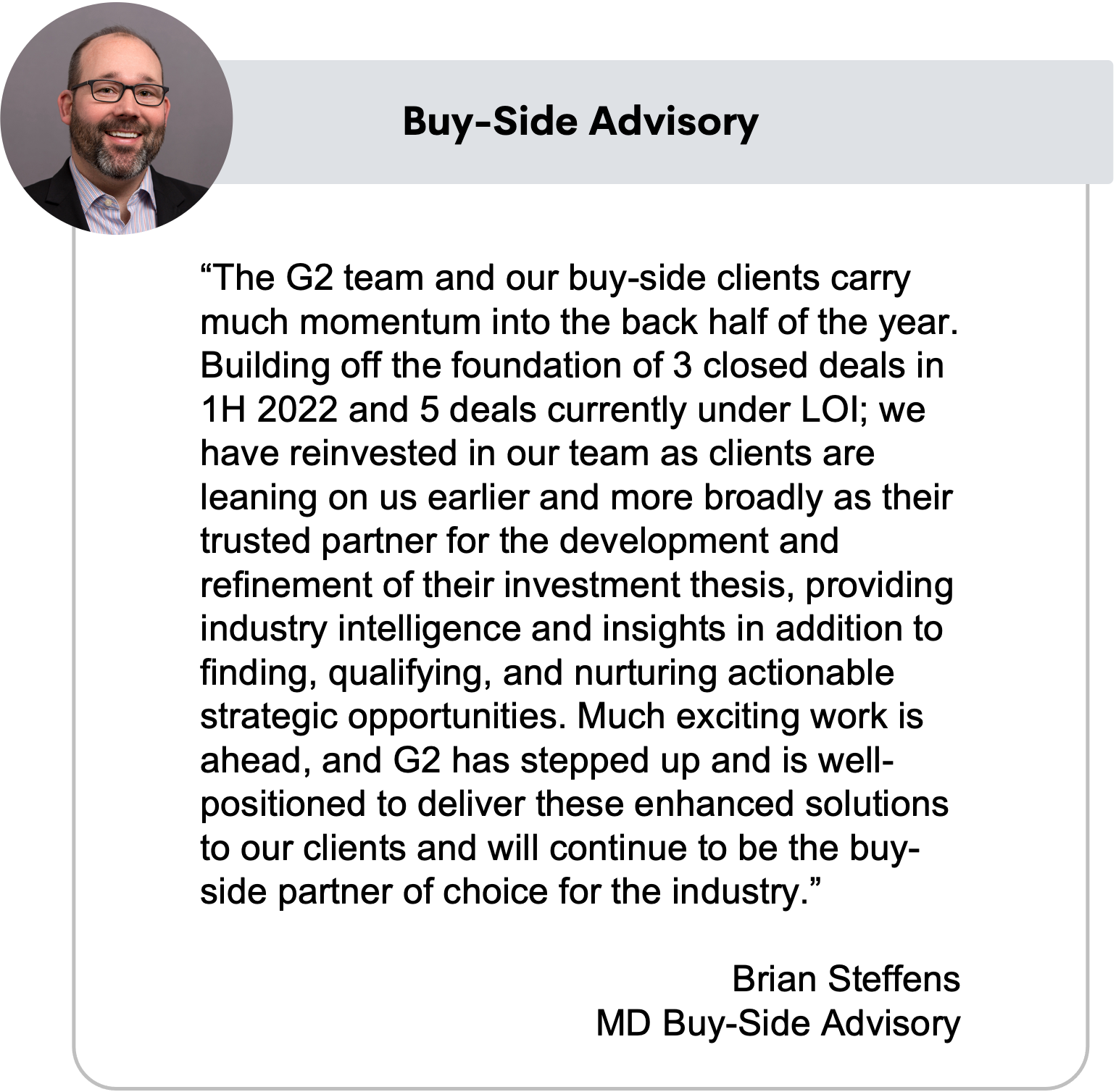

G2 has had an exceptional start to the year, actively supporting over 95 engagements across four industries, serving investment banking and restructuring clients. The firm has made significant investments to expand our leadership functions across the organization with the addition of:

- Brian Steffens – Managing Director, Buy-Side Advisory

- Brian Schofield – Managing Director, Head of Capital Markets

- Jim Cotter – Managing Director, Industrials & Manufacturing

- Jereme LeBlanc – Director, Buy-Side Advisory

As we carry our momentum to the back half of 2022, G2 maintains a steadfast commitment to meeting the evolving needs of our clients across all stages of the business lifecycle. Whether executing strategic growth through M&A or supporting businesses troubled by unsustainable capital structures or challenging industry or operating conditions, G2 is your partner from beginning to end.

CLOSED TRANSACTIONS:

|  |  |  |

|  |  |  |

|

NOTABLE ENGAGEMENTS:

|  |  |  |

|  |  |  |

PERSPECTIVES FROM LEADERSHIP

|  |

|  |

|  |

|  |