THE 2023 BANKING FAILURES

Two weeks ago, Silicon Valley Bank (SVB) became known as the second-largest commercial bank failure in the history of the United States. In the days that followed the collapse, global financial markets witnessed intense turbulence, with several additional dislocations in the bank and credit markets and mounting distress across institutions that had been struggling against the backdrop of a sharp rise in interest rates this past year. With rapidly evolving, dynamic capital markets combined with the media frenzy surrounding the global economy, many fear what could come next. Investors and business owners should focus on safeguarding their businesses for the future.

The G2 team supports its clients and industry partners regardless of circumstances. We guide companies through moments of complexity or rapid change through our deep operational experience and dedicated financial advisory expertise. Over the last 12 years, we have helped over 400 clients navigate complex situations across up and downtrend market cycles.

If you are seeking guidance or looking to better understand potential business implications of the present state of the economy, G2 is here to help. Our restructuring & insolvency, capital markets, investment banking, and interim management teams are ready to extend support through these uncertain times.

You are not alone. Here are some of the ways we can help:

- Our restructuring and insolvency advisors can help triage portfolio exposure and evaluate risk for borrowers/portfolio companies.

- Our capital markets team can secure additional financing to ensure your companies have sufficient liquidity.

- Our team of over 50 professionals is ready to support complex operational needs in helping your company proactively adapt to the changing environment, reduce costs, develop forecasts, and manage liquidity.

- We have a deep bench of interim management executives and subject matter experts to deploy as CEOs, CROs, or CFOs for short or long-term assignments to help your companies navigate the current environment.

Reach out to learn more about how we can support you today.

G2 CAPITAL ADVISORS SERVED AS THE EXCLUSIVE BUY-SIDE ADVISOR TO PEAK TOOLWORKS ON ITS ACQUISITION OF EXPERT DIE INC., A LEADER IN BLADE SALES AND SHARPENING SERVICES ACROSS THE SOUTHEAST UNITED STATES.

CLIENT

Peak Toolworks (“Peak”) is North America’s largest manufacturer of engineered diamond and carbide cutting tools serving the secondary woodworking, metal, composite, and other end markets. With two manufacturing facilities and 12 service centers across the United States and Canada, Peak provides customers a regionally focused network of direct sales and service, offering direct access to the top cutting tool brands from one convenient source. Peak puts people first in everything they do, allowing them to be a trusted, reliable partner for their clients.

SITUATION

Peak has a well-established reputation as the largest network in North America for cutting tools. To advance its service offering and capabilities to better service its clients, Peak implemented a successful M&A strategy to partner with a business that expands their geographical presence and service capabilities.

ENGAGEMENT

G2 Capital Advisors, LLC (“G2”) served as the exclusive buy-side advisor to Peak, leading a bespoke buy-side effort focused on identifying and engaging with businesses with a strong market presence and service offering within the cutting & sharpening industry.

OUTCOME

G2’s mandate with Peak Toolworks began in 2020 and led to the successful acquisition of Expert Die Inc. The acquisition brings industrial knife sharpening to the Peak service portfolio, offering new sharpening & repair locations as well as new sales capabilities to Peak’s existing customers. Additionally, Peak’s acquisition of Expert Die Inc. creates new relationships that will lead to new avenues for growth.

Kerry Baskins, President & CEO of Peak Toolworks, commented, “I am excited to add Expert Die to the Peak family. We are pleased with the work G2 Capital Advisors dedicated to this acquisition to help share our culture, goals, and vision with Expert Die.”

“Expert Die, Inc. has an exceptional brand name and reputation. This acquisition will significantly grow Peaks footprint while also increasing our ability to drive additional value for our customers across the country. We are excited to continue executing on the Peak strategy and look forward to the company’s further growth.”

CONTACTS ON THIS DEAL:

Victoria Arrigoni, MD, Head of Industrials & Manufacturing M: 619.742.6441 E: [email protected]

Matt Ball, Vice President M: 978.914.4421 E: [email protected]

Zachary Kalman, Associate M: 413-351-1491 E: [email protected]

CLIENT

PureRED is a leading marketing, data, and technology partner delivering digital content at scale. With over 50 years of experience, PureRED works with 14 of the largest 25 retailers in the country and provides fully integrated marketing and advertising capabilities for Fortune 500 brands across retail, consumer packaged goods, financial services, and specialty brands.

SITUATION

Throughout its partnership with RFE, PureRED has grown and evolved as a marketing services business. To deeper serve its customers, PureRED sought additional strategic capabilities across retail marketing, technology-enabled, and analytics solutions. The team enlisted G2’s M&A advisory solution to enhance an extensive organic initiative to expand digital capabilities.

ENGAGEMENT

G2 Capital Advisors, LLC (“G2”) partnered with RFE Investment Partners and PureRed Management as the exclusive buy-side advisor to the Company. The partnership included a comprehensive strategy definition process to identify accretive growth opportunities and targeted outreach to relevant candidates in the marketing services industry.

OUTCOME

G2’s mandate with PureRED brought a successful acquisition of Haddad & Partners, a leading design and digital agency. The Fairfield, CT-based company maintains a global footprint to deliver design, copy & content, animation, digital delivery, and analytics solutions for multi-national brands in technology, financial services, and consumer products industries.

“This is a great day and we are energized about the possibilities this new partnership affords our clients and teammates,” said Brian Cohen, CEO at PureRED and H&P. “H&P’s expertise in content creation, innovation, and digital delivery complements PureRED’s technology, data, and creative offerings seamlessly. DJ and his team have built an impressive company, and their culture aligns perfectly with ours. The future is bright for all of us.”

“This is the next evolutionary step for H&P and we’re beyond excited to be taking it with PureRED. This move expands our talent pool and capabilities, and it also provides our clients with plenty of new offerings, while giving our global team some amazing opportunities for growth,” said DJ Haddad, Founder and Chief Creative Officer at H&P. “We look forward to the exchanging of cultures and ideas between our two companies and the benefits it’ll bring to all of our clients.”

Andrew Keleher, Director of Business Development at G2 Capital Advisors, and lead contact on G2’s engagement with RFE and PureRED added, “It is incredible to see these businesses join together. Through our close relationship with RFE, we built a robust strategy to support PureRED via add-on acquisitions. It is exciting to see how well DJ and Haddad & Partners fit that strategy, and we are thrilled to see how the businesses will continue to strengthen each other as a combined organization. G2 is looking forward to supporting continued growth for the organization in 2023.”

About PureRED

PureRED is an award-winning, 600+ associate, PE-owned advertising, marketing, and technology company that creates and distributes digital content at scale for 14 of the largest 25 retailers in the US and provides Fully Integrated Advertising and Marketing solutions for Fortune 500 Consumer and Retail brands.

About Haddad & Partners

Haddad & Partners is a full-service, global creative agency made up of a veteran team of problem solvers, designers, copywriters, animators, developers, video producers, and all-around doers. Since 2007, they’ve worked tirelessly for some of the world’s biggest brands, such as Microsoft, Amazon, TD Bank, Fannie Mae, and Total Wine & More, in generating innovative and measurable creative campaigns while never losing sight of the importance of maintaining a highly collaborative remote working environment.

About RFE Investment Partners

RFE Investment Partners is a private equity firm focused on making control investments in established small market companies located in the United States. RFE is a long-standing firm founded in 1980 with over 40 years of experience investing in the lower middle market. RFE’s investment strategy is to transform its portfolio companies from the lower end of the market to fully professionalized and market-leading middle-market companies. RFE is currently investing out of Fund IX.

About G2 Capital Advisors

G2 Capital Advisors provides M&A, capital markets, and restructuring advisory services to the middle market. We offer integrated, multi-product, and sector-focused services by pairing highly experienced C-level executives with specialist investment bankers. We aspire to be the trusted advisor to our clients, including corporations and institutional investors.

CONTACTS ON THIS DEAL:

Andrew Keleher, Director, Business Development T: 860.748.6480 E: [email protected]

Ben Stevenson, Associate: T: 412.680.9100 E: [email protected]

Jeremy Caulkins, Associate: T: 585.645.4472 E: [email protected]

Jereme LeBlanc, Managing Director, Buy-Side T: 917.541.5164 E: [email protected]

G2 Capital Advisors is pleased to present its Consumer & Retail, Industrials & Manufacturing, Technology & Business Services, and Transportation & Logistics market updates. Click to download the full reports, including commentary and analysis on Q4 M&A and market trends within our core focus sectors.

Consumer & Retail Market Trends:

While retail foot traffic rose for practically all categories, it wasn’t enough to counter the effects of inflation combined with deep holiday discounting. Inflation was up 6.5% from year-ago levels – while lower than the peaks seen earlier in the year, it was enough to dampen consumer confidence heading into holiday shopping. Moreover, food prices continue to climb, driving consumers to devote more of their dollars to necessities rather than discretionary goods.

Industrials & Manufacturing Market Trends:

After two years of pandemic-fueled disruption, a host of new challenges arose in 2022 for packaging businesses as increased inflation and interest rates, the war in Ukraine, and commodity prices hitting historic highs, impacted the pace of M&A activity. Despite the challenging macroeconomic environment, the appetite among private equity groups and strategic buyers for well-established packaging companies remained high.

Technology & Business Services Market Trends:

The US economic outlook remains unclear with a general negative sentiment. Increasing interest rates, supply chain issues, and geopolitical uncertainty are putting pressure on multiples in many segments of the market. Value creation and a focus on fundamentals will be key themes in 2023 with businesses and investors intent on how they build value organically and inorganically in line with core growth theses. For many privacy equity firms, the near-term focus will likely be on add-on acquisitions that enhance existing portfolio companies.

Transportation & Logistics Market Update:

As transportation and logistics providers navigate an uncertain economic and freight environment, operators in California are faced with an additional challenge as Assembly Bill 5 California (“AB5”) takes effect following numerous legal battles. AB5, which became state law in 2019, requires companies to reclassify many independent contractors as employees, prohibiting trucking companies from working with owner-operators and 1099 drivers in California. In an environment where a driver shortage persists, eliminating a strategy that provides trucking companies scalability and flexibility could have lasting implications across the freight market.

Questions? Please reach out to our team below.

Our team focuses on assisting private equity partners by providing high quality deal flow, add on acquisition, capital markets and restructuring support. G2 continues to invest in the private equity community as trusted partners of choice.

2022 SELECT TRANSACTIONS COMPLETED WITH SPONSORS

PARTNERS FROM BEGINNING TO END.

G2 Capital Advisors provides M&A, capital markets, and restructuring advisory services to the middle market. We offer integrated, multi-product, and sector-focused services by pairing highly experienced C-level executives with specialist investment bankers. We aspire to be the trusted advisor of choice.

CAPABILITIES:

INDUSTRY FOCUS:

G2 Capital Advisors announced today that its client ITOCHU International Inc. (‘ITOCHU’ or the ‘Company) and its subsidiary Enprotech Corp has entered into a definitive agreement to acquire American Hydro, a Wärtsilä Corporation business.

American Hydro is a leading North American provider of custom hydropower refurbishment solutions and turbine services. The Company leverages world-class advanced engineering, precision machining, large fabrication, and field services capabilities to power North American hydroelectric production.

Victoria Arrigoni, Managing Director & Head of Industrials and Manufacturing at G2 Capital Advisors commented “It has been an honor to be a part of expanding ITOCHU’s footprint in the hydropower and renewables market. The opportunity for ITOCHU to expand to the hydropower space is a pivotal moment for their machinery division’s go-to-market strategy.”

The addition of American Hydro to ITOCHU’s portfolio of businesses will expand industry segmentation into the renewable energy sector and position the organization to become a leading North American maintenance, repair, remanufacture and optimization solutions provider for heavy-industrial machinery and equipment.

The transaction is subject to regulatory approvals and is expected to close in the first half of calendar 2023.

| Primary Deal Contact: Victoria Arrigoni MD, Head of Industrials & Manufacturing [email protected] | Media Contact: Jennifer Johnson VP, Head of Marketing [email protected] |

Record-breaking post-Holiday sales masked a marked slowdown in overall retail spending. Despite Black Friday and Cyber Monday sales surpassing $20 billion for the first time in history, U.S. retail spending experienced its most significant decline of the year, suggesting households are making strategic financial decisions as they plan for the road ahead. The economy remains at an unprecedented crossroads, with many questions looming:

Will inflation continue to slow, and how much further could interest rates rise? The Fed continues to raise rates at a slightly slower pace and has signaled its intention to continue doing so at least through the spring.

Will a slightly slowing economy morph into a full-blown recession, and will the labor market remain strong? While sales and margins show signs of softening, the labor market continues to defy expectations, making it hard for the Federal Reserve to further ease the policy. Layoffs in the technology, media and real estate industries make headlines. Still, they represent a minuscule portion of the labor force, with overall jobless claims falling by 20,000.

How much longer will pandemic-era savings and easing supply chains buttress consumer spending, and will they continue to spend more on necessities? While personal savings soared to nearly $6.5 trillion in 2020, they’ve since dropped to below $500 billion, lower than the $1.4 trillion pre-pandemic. Despite supply chain imbalances driving discount sales as retailers looked to shed excess inventory, consumers are focusing their budgets on food and other staples and spending less on holiday categories such as electronics, clothing, and sporting goods.

Ultimately, is a recession inevitable, and how bad might it get? This remains anyone’s prediction, but for business owners, management teams, and industry leaders, any level of uncertainty should be met head-on – waiting to seek clarity can be a losing move.

Connect with G2 to discuss your 2023 strategic objectives. At G2 Capital Advisors, deep sector and operational expertise underscore our dedication to achieving success at all costs. We support clients through both healthy market cycles and times of distress, with a refusal to fail. We provide highly tailored advice to company-specific circumstances in an ever-changing world. Reach out today to start the conversation.

On the heels of the most extended credit cycle in recent memory, the last six months have delivered a long overdue dose of economic reality. Middle-market borrowers have enjoyed 10+ years of historically low rates and loose lending conditions (save for the brief, covid-induced, recession-that-wasn’t in mid-2020). However, the lending environment has changed due to the inflationary conditions we experience every day and the Fed’s actions to curtail them.

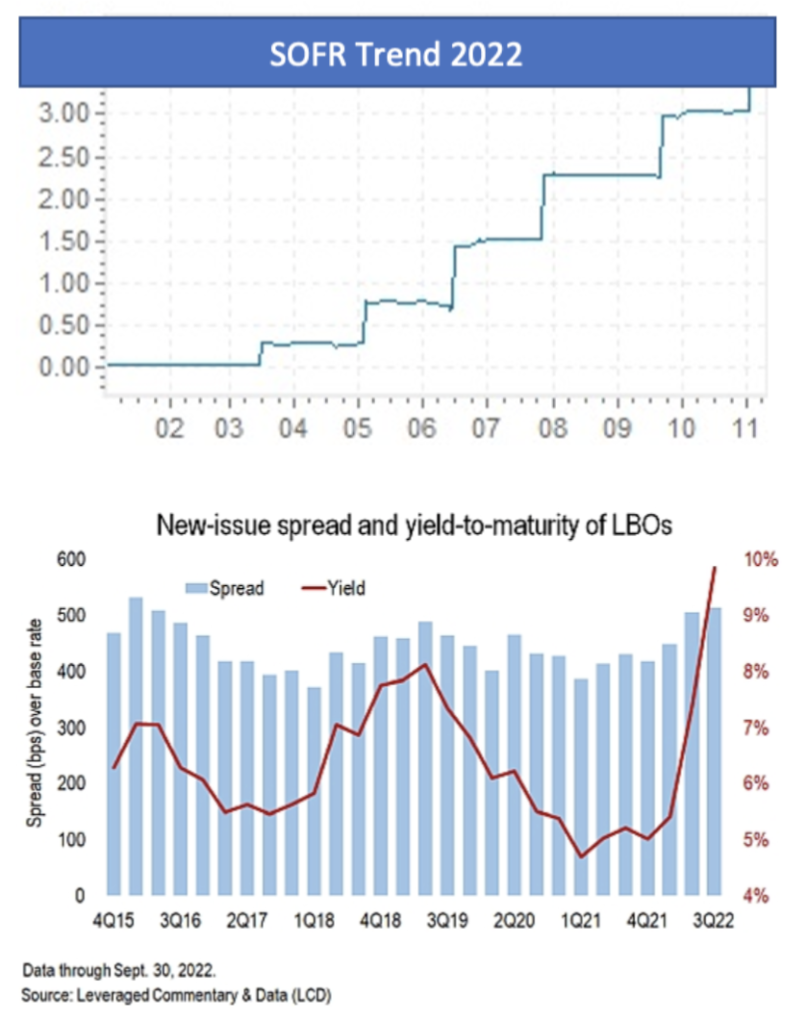

The Fed has raised the benchmark Fed Funds Rate 6 times and 375 basis points since March, with an additional 50-75 basis point increase expected in Mid-December. In turn, companies have seen borrowing costs skyrocket; SOFR, the index rate for new-issue corporate loans, stood at 3.8% on November 30th after beginning the year at near zero.

This SOFR spike, combined with middle market spreads that have widened ~75-150 bps and original issue discounts (OIDs) that have increased to 1.5-2.5% have driven yields for middle market senior secured loans to ~11-12% versus 5.75-7.25% at the end of Q1.

At the current levels, interest expense for a 4x levered business consumes 45% of EBITDA, which substantially limits debt capacity and has the knock-on effect of softening valuations. What’s more, the 3-month Term SOFR forward curve peaks at 4.9% in April ’23 and remains above 4% through March ’24.

Now that we’ve addressed the bad, here’s the good: while lending conditions have deteriorated, this downcycle will bear little resemblance to 2008/09 due to the secular shift in the composition of middle market lenders.

Fundamental Shift in Middle Market Loan Demand

The lender landscape has changed materially since 2009. In the halcyon days of 2005-2007, commercial banks and institutional investors, i.e., pro rata and institutional syndicated loans, accounted for over 90% of middle market volume. Private credit was in its relative infancy and hardly moved the needle regarding loan volume. Thirteen years later, private credit is now the dominant source of financing for middle market companies with a market size of $1.2 trillion vs. $284 billion in 2008.

Why Does it Matter

Looking back on the GFC, it was characterized by an utter lack of liquidity, including within the middle market. But as previously noted, commercial banks accounted for the lion’s share of volume. As risk-off entities whose primary objective is to not lose money, when the proverbial music stopped in 2008, so did their desire and willingness to provide new credit. In fact, it was banks’ withdrawal from the market that turbocharged private credit’s growth.

Conversely, private lenders have different capabilities and incentives to deploy capital in times of volatility. First, rather than avoiding risk, private lenders price, and structure around it. Second, fund managers are compensated for deploying capital, not waiting out the storm. One need not look any further back than Q3, when, per LCD, “direct lending deals tracked by LCD exceeded syndicated loans and high yield bonds…combined.”

As a result of the new landscape, the private credit market will remain open for business regardless of the depth of the looming recession, and financing will remain available for most borrowers, albeit with very lender-friendly pricing and terms.

G2 Capital Advisors is pleased to present its Transportation & Logistics industry update for Q3 2022, providing commentary and analysis on M&A and market trends within the sector.

After continued momentum across global transportation services in 1H 2022, a 60%+ year-over-year decrease in global container freight rates (as measured by the Freightos Baltic Index) in Q3 has reinforced economic weakness. More specifically, the cost to ship products across the Trans-Pacific trade lane has cooled from record highs of over $20,000 per container in Q3 2021 to less than $3,000 per container by September 2022. These trends are signaling a drop in consumer demand amid rising inflation and a rebalancing of consumer spending to essential goods and services, while retailers manage bloated inventory levels and temper expectations for holiday spend.

As demand growth has stalled from a muted peak season, ocean vessels are not fully utilized causing spot rates to drop below contract rates. These carriers have increased blank sailings as a strategy to match supply with demand in hopes of establishing a pricing floor. It remains uncertain how quickly this imbalance will correct and whether carriers will be forced to maintain lower capacity in response to the declines experienced across most major shipping routes.

Pricing pressure remains the primary industry challenge which has forced freight forwarders to continue adopting and tailoring processes, technologies and service capabilities to further differentiate their solutions. Those providers with an automated, self-service solution that can provide real-time visibility portals, rate optimization engines, and effective analytics and reporting for customer milestone communication will differentiate their services, improve customer retention and drive future growth and profitability through an uncertain market.

G2 Capital Advisors is pleased to present its Technology & Business Services (“T&BS”) industry update for Q3 2022, providing commentary and analysis on M&A and market trends within the Technology & Business Services sectors and sub-sectors.

The US economic outlook remains uncertain with a general negative sentiment. While supply chain issues are easing, the hiring and job markets remain strong, and consumer spending while slowing is not plummeting, The Conference Board forecasts that economic weakness will intensify and spread more broadly over the coming months driven by inflation and a hawkish Federal Reserve stepping in to aggressively increase the federal funds rate. The Federal Reserve typically walks rates up slowly because they work with a lag, but one that can be powerful. The current rate of increases has them moving more quickly to offset the lag which is a delicate balance. The Federal Reserve’s rate increases represent the fastest tightening since the 1980s when they ultimately raised rates to nearly 20%, sending unemployment to greater than 10%.

The impact on the T&BS M&A market is largely just emerging. We are seeing a slowdown in response increasing costs of leverage and the general uncertainty in the market as well as a marked increase in scrutiny of fit and during diligence. Additionally, many private equity firms were able to return capital to investors from strong exits over the last couple of years, taking the pressure off near term exits. However, quality deals are getting done and 2022 volume is expected to be up from pre-pandemic levels.

Several sectors in particular have seen increased deal volume generated by significant tailwinds. Cybersecurity software and services deals have received interest and attention driven by the ongoing diplomatic tensions between the US and Russia created by Russia’s invasion of Ukraine earlier in the year, as well as the continued fraying of relations with China in response to a host of factors. There has been a similar boom in IT consulting services sector, as companies continue to need highly-specialized, knowledgeable consultants to help them adapt to the ever-changing technology landscape and offset a tight skilled labor force.