On the heels of the most extended credit cycle in recent memory, the last six months have delivered a long overdue dose of economic reality. Middle-market borrowers have enjoyed 10+ years of historically low rates and loose lending conditions (save for the brief, covid-induced, recession-that-wasn’t in mid-2020). However, the lending environment has changed due to the inflationary conditions we experience every day and the Fed’s actions to curtail them.

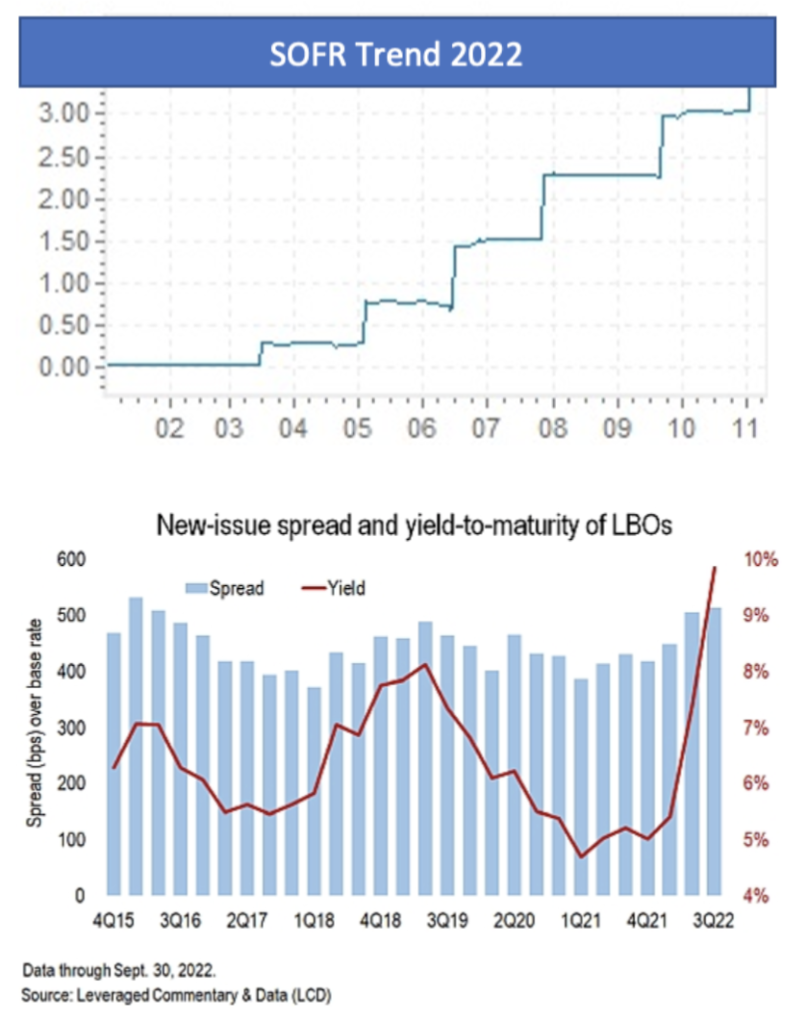

The Fed has raised the benchmark Fed Funds Rate 6 times and 375 basis points since March, with an additional 50-75 basis point increase expected in Mid-December. In turn, companies have seen borrowing costs skyrocket; SOFR, the index rate for new-issue corporate loans, stood at 3.8% on November 30th after beginning the year at near zero.

This SOFR spike, combined with middle market spreads that have widened ~75-150 bps and original issue discounts (OIDs) that have increased to 1.5-2.5% have driven yields for middle market senior secured loans to ~11-12% versus 5.75-7.25% at the end of Q1.

At the current levels, interest expense for a 4x levered business consumes 45% of EBITDA, which substantially limits debt capacity and has the knock-on effect of softening valuations. What’s more, the 3-month Term SOFR forward curve peaks at 4.9% in April ’23 and remains above 4% through March ’24.

Now that we’ve addressed the bad, here’s the good: while lending conditions have deteriorated, this downcycle will bear little resemblance to 2008/09 due to the secular shift in the composition of middle market lenders.

Fundamental Shift in Middle Market Loan Demand

The lender landscape has changed materially since 2009. In the halcyon days of 2005-2007, commercial banks and institutional investors, i.e., pro rata and institutional syndicated loans, accounted for over 90% of middle market volume. Private credit was in its relative infancy and hardly moved the needle regarding loan volume. Thirteen years later, private credit is now the dominant source of financing for middle market companies with a market size of $1.2 trillion vs. $284 billion in 2008.

Why Does it Matter

Looking back on the GFC, it was characterized by an utter lack of liquidity, including within the middle market. But as previously noted, commercial banks accounted for the lion’s share of volume. As risk-off entities whose primary objective is to not lose money, when the proverbial music stopped in 2008, so did their desire and willingness to provide new credit. In fact, it was banks’ withdrawal from the market that turbocharged private credit’s growth.

Conversely, private lenders have different capabilities and incentives to deploy capital in times of volatility. First, rather than avoiding risk, private lenders price, and structure around it. Second, fund managers are compensated for deploying capital, not waiting out the storm. One need not look any further back than Q3, when, per LCD, “direct lending deals tracked by LCD exceeded syndicated loans and high yield bonds…combined.”

As a result of the new landscape, the private credit market will remain open for business regardless of the depth of the looming recession, and financing will remain available for most borrowers, albeit with very lender-friendly pricing and terms.

While the economic outlook for middle market companies is mixed as we move into 2023, there are still opportunities for growth and success. By being strategic and focused on operational efficiency, cost optimization, and alternative financing options, middle-market companies can navigate these challenges and emerge stronger on the other side.

The rising-rate environment will have an enormous impact on the middle market. Buyers will be more selective and diligent in the companies they acquire, and available liquidity and deal flow will likely decline. Floating-rate debt issuers are especially vulnerable today—particularly those with heavy interest burdens, limited free cash flow, and near-term maturities.

Brian Schofield, MD, Head of Capital Markets, G2 Capital Advisors

The tightening monetary policy, declining GDP growth, and lower public and private valuations will see an impact on middle-market companies in the coming months. With the concern of inflation, the economy slowing down and more, this is what we can expect to see from the middle market:

- Selective and diligent buyers

- Declining deal flow and available liquidity

- Vulnerability among companies

- Covenant-lite loans may assuage default concerns

- Evolutions of investors’ ties with “storied” credits

Our G2 team provides a unique platform, combining deep operational industry experience with capital markets product expertise to meet client growth goals and special situations.

Learn more about our capital marketing advisory.

Capital market analysis & backdrop

Increase in inflation rate remains a crucial concern: After months of claiming inflation was “transitory,” the U.S. Federal Reserve (the Fed) has found itself behind the curve, fighting the highest inflation rate in four decades. The Consumer Price Index (CPI) increased 8.5% for the 12 months ended March 2022, following a year-over-year rise of 7.9% as of February 2022.

The Fed is aggressively tightening monetary policy: The Fed is hiking interest rates—its most aggressive pace of policy tightening since the early 2000s. The Fed voted to raise interest rates by 25 bps in March and 50 bps in May and anticipates an additional 50 bps of hikes during its next two meetings. In addition, the Fed has begun to shrink its $9 trillion balance sheet. Meanwhile, the 10-year Treasury rate is hovering around 3.0%, its highest level since November 2018.

Declining growth as economy is slowing down: U.S. GDP growth fell to 1.4% in the first quarter. However, it was affected by certain factors that should ease throughout the year, including spiking COVID cases and slowing inventory growth. The Fed must balance tightening activity with the risk of tipping the U.S. economy into a recession.

Public markets have been hit hard: Rising interest rates, inflationary pressures, and geopolitical instability have resulted in a public market rout since the beginning of the year. While technology companies and other growth investments have seen the most significant impact, the sell-off has been broad-based and is spilling into the private markets, as further discussed below.

What does this mean for the middle market?

Expect buyers to become more selective and diligent: Valuations in the public markets tend to have a gravitational pull on private transactions. We expect buyers in the middle market to dig in further during due diligence and be highly selective in the companies they seek to acquire.

Available liquidity and deal flow will likely decline: Demand for middle-market loans may exhibit volatility in the second of 2022 as it did in the second quarter of 2020 when deal flow slowed significantly due to uncertainty surrounding the pandemic. Increased borrowing costs will render opportunistic financings less attractive and likely result in muted loan volume for the balance of 2022.

Some companies are more vulnerable than others: Due to the prevalence of floating-rate, debt-heavy capital structures, debt-bearing middle market businesses and loan issuers are more vulnerable than their larger corporate counterparts. Especially vulnerable are companies with limited free cash flow, heavy interest burdens, and near-term maturities that will need to be refinanced at higher interest rates.

Covenant-lite loans may assuage default concerns: A heavy mix of covenant-lite loans, which weaken creditor protections, may help stave off defaults. When debt agreements include maintenance covenants, improved operating performance can mitigate the effects of higher interest rates as monetary policy continues to tighten.

Investors’ willingness to lean in on “storied” credits will evolve: After massive deal activity in late 2021, deal flow has decreased in early 2022, and investors have been more willing to consider complex credits this year. But we expect investor demand to pull back from storied credits as the forward calendar continues to build and scrutiny from lenders increases due to current headwinds.

Market volatility is high, and interest rates are projected to rise. For middle market companies looking to raise capital, now is an opportune time to leverage the expertise of a seasoned capital markets team to navigate the complex market environment and provide greater certainty of execution.”

Brian Schofield, MD, Head of Capital Markets, G2 Capital Advisors

How do these trends affect you?

Our capital markets team would welcome the opportunity to share our perspectives on today’s dynamic capital markets environment and how it affects your specific situation. We have deep experience providing strategic capital markets advice to middle market companies, and we pride ourselves on making the deal experience as efficient as possible for management teams and owners. Contact us to start a conversation today and begin working towards your capital market goals.

G2 Capital Advisors, LLC (“G2”), a leading full-service investment bank and restructuring advisory firm, announced today that Brian Schofield joined as Managing Director, Head of Capital Markets. In this role, Schofield will lead the firm’s capital markets platform with a focus on originating, structuring, and executing debt- and equity-financings in service of private equity firms and middle-market businesses. Schofield will be based out of the Los Angeles area and brings over 15 years of investment banking experience to the position.

“We are pleased to welcome Brian to the G2 team. His experience, knowledge, and proven track record of successfully navigating the complexity of today’s capital markets will serve as an integral aspect of G2’s growth,” said Ben Wright, Chief Operating Officer at G2 Capital Advisors.

Prior to joining G2, Schofield served as a Managing Director at Capstone Partners where he helped lead the Debt Advisory Group. During his time at Capstone, Schofield led capital markets transactions across multiple sectors including environmental services, business services, mining, technology, consumer, and marketing services, amongst others.

Before joining Capstone Partners, Brian was Co-Founder and Partner of Lampert Advisors, a New York-based debt advisory firm. At Lampert he advised middle-market companies and financial sponsors on over $2.5 billion in completed transactions, including acquisition financings, dividend recapitalizations, and restructurings, as well as several buy-side and sell-side M&A transactions.

“I am thrilled to join the team at G2 during a time of such organic growth and expansion. Market demand for capital markets advisory services has never been stronger and we’re committed to making G2 the go-to investment bank for private equity sponsors and business owners seeking to raise debt or equity capital,” said Brian Schofield, Managing Director, Head of Capital Markets.

G2 Capital Advisors offers M&A advisory services, including sell-side and buy-side advisory capital markets, operational and financial restructuring, and related strategic advisory services to complement a client’s growth plan. With a distinguished track record of advising on nearly $4 billion in closed M&A transactions, providing integrated investment banking services for high-growth companies in the Consumer & Retail, Industrials & Manufacturing, Technology & Business Services, and Transportation & Logistics industries.